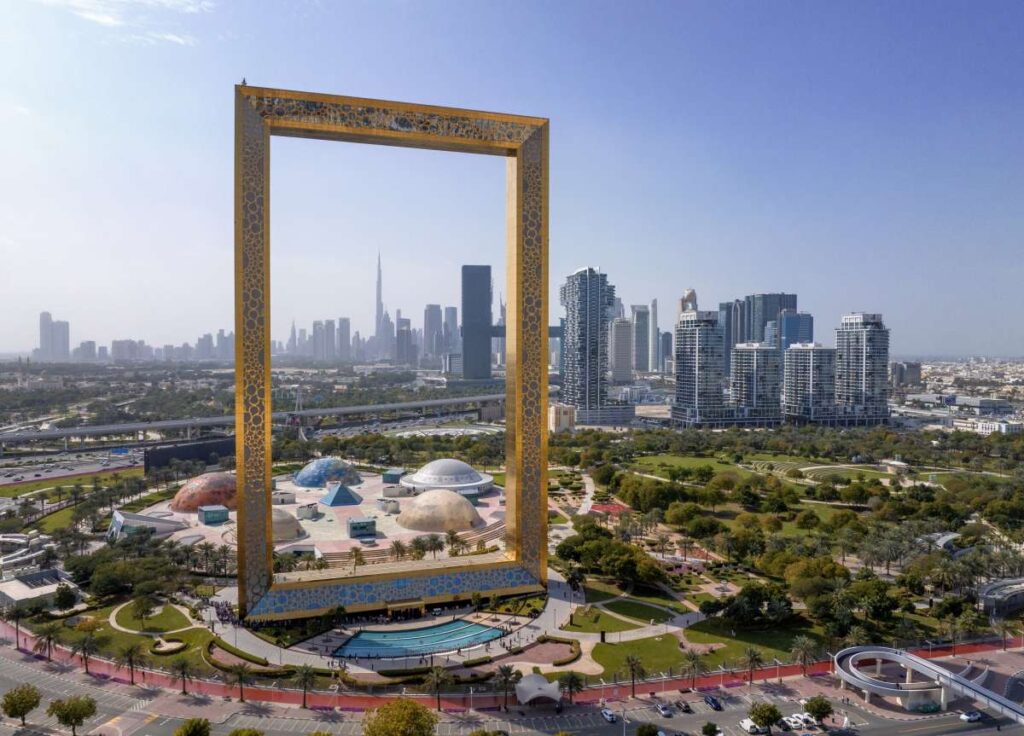

With over 50 free zones in the UAE, how do you know which one is best for you? Setting up in the right Dubai free zones will position your business for success.

Registration Process

Setup Your Company in Dubai Today

With over 50 free zones in the UAE, how do you know which one is best for you? Setting up in the right Dubai free zones will position your business for success.

However, navigating the intricacies of free zone company formation can be complex and overwhelming without proper guidance. Doing it through a company formation specialised company allows you to leverage the knowledge and experience of professionals who specialize in this domain. Moreover, it enables you to start your operations in Dubai’s thriving business environment with confidence.

What are the benefits of registering a company in the UAE?

How We Work

Frequently asked questions

To set up a business in the UAE, you will generally need to follow these steps:

a. Choose the type of business entity: Options include mainland company, free zone company, or offshore company. Each has different requirements and benefits.

b. Select a business name: Ensure it complies with the naming guidelines and is available for registration.

c. Find a local sponsor or partner: Depending on the business type, you may need a UAE national as a sponsor or partner.

d. Secure the necessary licenses: Obtain the required licenses and permits from the relevant government authorities.

e. Register the business: Complete the registration process with the Department of Economic Development (DED) or the relevant free zone authority.

f. Lease an office space: Provide proof of a physical address where your business will operate.

g. Open a corporate bank account: Deposit the required share capital and open a bank account in the UAE.

Yes, foreigners can own businesses in the UAE. However, the ownership structure and restrictions depend on the location of the business:

a. Mainland Company: In mainland UAE, a local sponsor or partner, who must be a UAE national, is required. The local partner typically holds a 51% share, while the foreign investor holds the remaining 49%.

b. Free Zone Company: Free zones allow 100% foreign ownership, with no requirement for a local sponsor or partner. However, these companies are limited to operating within the free zone or outside the UAE.

c. Offshore Company: Offshore companies are typically used for international operations and do not allow local UAE business activities. They also offer 100% foreign ownership.

The costs of setting up a business in the UAE vary depending on the business type, location, and specific requirements. Here are some common expenses to consider:

a. License fees: These vary based on the type of license and business activity.

b. Registration fees: These include company registration fees with the relevant authority.

c. Office space: The cost of leasing office space depends on the location, size, and type of premises.

d. Visa fees: If you plan to have employees, you will need to factor in the costs of employee visas.

e. Sponsorship fees: If setting up a mainland company, you may need to pay an annual sponsorship fee to your local sponsor or partner.

Free zones in the UAE offer several benefits for businesses, including:

a. 100% foreign ownership: Free zones allow full ownership by foreign investors without the need for a local sponsor or partner.

b. Tax advantages: Free zones typically provide tax exemptions on corporate and personal income taxes for a specific period.

c. Customs privileges: Companies in free zones enjoy customs duty exemptions for importing and exporting goods.

d. Simplified procedures: The setup process in free zones is streamlined, with fewer bureaucratic hurdles and faster registration times.

e. Infrastructure and facilities: Free zones provide state-of-the-art infrastructure, office spaces, warehouses, and logistics facilities.

f. Repatriation of profits: Companies can repatriate 100% of their capital and profits outside the free zone without restrictions.

The time required to set up a business in the UAE varies depending on the type of business and the specific requirements. Generally, the process can take anywhere from a few days to several weeks.